I’ve been carrying an RFID-based Oyster card for years. It’s a fantastic way to use the transport network in London especially if you pay-as-you-go rather than using a seasonal travelcard. You just “touch in and out” and fares are deducted.

It’s no longer necessary to have to work out how many journeys you’re going to do to decide if you need a daily travelcard or not – the amount is automatically capped at the price of a daily travelcard, if you get to that point. “Auto top-up” means money is transferred from your bank to your card when you get below a certain threshold so you never have to visit a ticket office (especially given they’ve closed them all) or a machine. It’s amazing to think they’ve been around since 2003.

More recently it’s possible to pay for travel with a contactless payment card a.k.a. Visa PayWave or Mastercard Paypass. However, that leads to problems if, like most people, you carry more than one card in your wallet or purse – the Oyster system may not be able to read your Oyster card or worse, if your contactless payment card is compatible, it takes payment from the first card it can communicate with. If you have an Oyster seasonal travelcard, you don’t want to pay again for your journey by paying with credit card.

TFL have recently started promoting this phenomenon under the name “card clash”.

There’s even a pretty animation:

I first noticed card clash in 2010 when I was issued a new credit card with contactless payment. It went straight in my wallet with my Oyster and other payment cards and the first time I tried to touch in by presenting my wallet (as I’ve always done with Oyster) – beeeep beeeep beeeep (computer says no).

It didn’t take me long to work out that the Oyster reader couldn’t distinguish between two RFID-enabled cards. I soon had a solution in the form of Barclaycard OnePulse – a combined Oyster and Visa card. Perfect!

I could now touch in and out without having to get my card out of my wallet again. But not for long…

I don’t know about you but I like to carry more than one credit card so if one is declined or faulty, I can still buy stuff. I had a card from Egg Banking for that purpose. To cut a long story, slightly shorter, Egg were bought by Barclaycard who then replaced my card with a new contactless payment enabled card. Oh dear, card clash again.

I wrote to Barclaycard to ask if they could issue a card without contactless functionality. Here’s the response I got:

All core Barclaycards now come with contactless functionality; this is part of ensuring our cardholders are ready for the cashless payment revolution. A small number of our credit cards do not have contactless yet but it is our intention these will have the functionality in due course. That means we are unable to issue you a non-contactless card.

Please be assured that contactless transactions are safe and acceptance is growing. It uses the same functionality as Chip and PIN making it safe, giving you the same level of security and as it doesn't leave your hand there is even less chance of fraud.

I trust the information is of assistance.

Should you have any further queries, do not hesitate to contact me again.

I was very frustrated by this – I was already ready for the “cashless payment revolution” with my OnePulse card! Now, I was back in the situation where I would have to take the right card out of my wallet – not the end of the world but certainly not the promised convenience either. Barclaycard’s answer is to carry two wallets – helpful!

I’m certainly not the only one who has issues with card clash. I’m not the only one to notice TFL’s campaign to warn travellers of the impending doom as contactless payment cards become more common.

So what’s the solution? If your card company isn’t flexible about what type of cards they issue and you can’t change to one that is (I hear HSBC UK may still be issuing cards without contactless payment on request), another option is to disable the contactless payment functionality. Some people have taken to destroying the chip in the card by putting a nail through it, cutting it with a knife or zapping it. However, that also destroys the chip and PIN functionality which seems over the top. You can probably use the magnetic strip to pay with your card but presenting a card with holes in it to a shop assistant is likely to raise concerns.

RFID cards have an aerial which allows communication with the reader and supplies power to the chip via electromagnetic induction (the zapping technique above overloads the chip with a burst of energy by induction). This means we can disable RFID without disabling chip and PIN by breaking the aerial circuit, meaning no communication or induction.

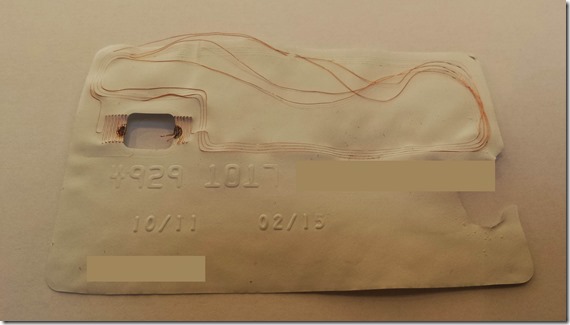

The aerial layout varies. I dissected an old credit card to get an idea where the aerial was in my card (soaking in acetone causes the layers of the card to separate). Here you can see that the aerial runs across the top and centre of the card.

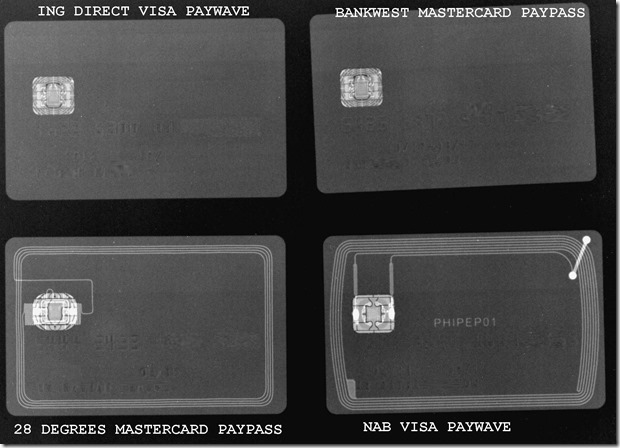

There are some helpful x-rays on the interwebs now showing some alternate layouts.

The aerial can be broken with a hole punch or soldering iron but I’ve found that making a small cut across the aerial is sufficient. It’s not necessary to cut all the way through the card – all that’s needed is to cut through to the layer containing the aerial. Start with a shallow cut and make it deeper if required. From the images above, a cut to the top of the card is likely to disable most cards.

The central cut on this card wasn’t effective. The cut at the top was.

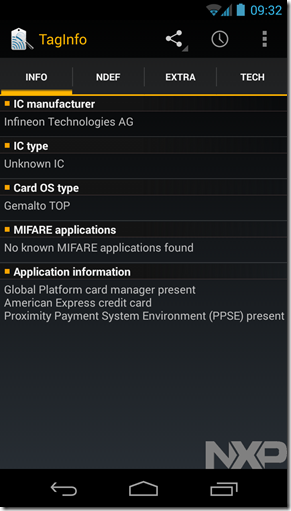

If you have an NFC-enabled smartphone, it’s possible to test the card to check that contactless is disabled. I’m using NFC TagInfo on a Samsung Galaxy Nexus. Here’s the card above before:

and after the aerial is cut (the chip no longer registers):

Job done! The card continues to work with chip and PIN but doesn’t interfere with Oyster.

Barclaycard have thrown another spanner in the works for me – OnePulse is being withdrawn. The solution seems to be to switch to contactless payments instead of Oyster. Here’s hoping that TFL can finish implementing contactless payments (promised “later in 2014”) before my OnePulse is withdrawn.

Disclaimer: if you’re using sharp knives, have a responsible adult present. If you damage yourself or your cards, don’t blame me!